Muir Beach CSD Financials

Fiscal Year 2023/24

GENERAL

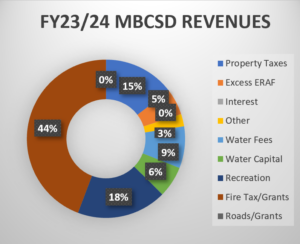

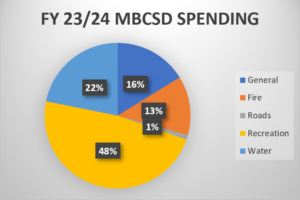

Muir Beach Community Services District (the District) is a separate governmental entity established in July 1958. The District provides water service, recreational service, roads and easement maintenance, and fire protection for a population approximating 550 in an area of 820 square acres in Muir Beach of Marin County. Revenues are derived principally from property taxes and water service charges collected from commercial and residential users within the District.

The District is governed by a five person Board of Directors (the Board) elected for four-year terms. The District’s legal authority and responsibilities are contained in the California Government Code sections 61000-61850 under the “Community Services District Law.”

THE GOVERNMENTAL-WIDE FINANCIAL STATEMENTS

Government-wide Financial Statements are prepared on the accrual basis, which means they measure the flow of all economic resources of the District as a whole.

The Statement of Net Position and the Statement of Activities present information about the following:

Governmental Activities – The District’s basic services are considered to be governmental activities. These services are supported by specific program revenues, state and federal grants, and general revenues from taxes and use of money.

Business-type Activities – The District’s enterprise water activities are reported in this area. Unlike governmental services, these services are supported by charges paid by users based on the amount of the service they use.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying policies of the District conform to U.S. generally accepted accounting principles and are applicable to governments. The following is a summary of the significant policies:

A. Basis of Presentation: The District’s basic financial statements are prepared in conformity with U.S. generally accepted accounting principles.

These statements distinguish between the governmental and business-type activities of the District. Governmental activities generally are financed through taxes, intergovernmental revenues, and other non-exchange transactions. Business-type activities are financed in whole or in part by fees charged to external parties.

B. Major Funds:

General Fund: This is used for all the general revenues of the District not specifically levied or collected for other District funds and the related expenditures.

Water Fund: This fund is used to account for the activities related to providing water service within the District.

C. Basis of Accounting: Governmental funds are reported using the current financial resources measurement focus and the modified accrual basis of accounting.

D. Budgets and Budgetary Accounting: The District annually adopts a budget for its General Fund using the modified accrual basis. Expenditures are controlled at the object (line item) level. Any amendments or transfers of appropriations must be approved by the Board. Appropriations lapse at the end of the fiscal year.

E. Use of Estimates: The basic financial statements have been prepared in conformity with U.S. generally accepted accounting principles, and as such, include amounts based on informed estimates and judgments of management with consideration given to materiality. Actual results could differ from those estimates.

CASH AND INVESTMENTS

Under the law, the District deposits in qualified public depositories are to be totally insured.

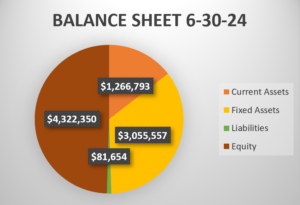

CAPITAL ASSETS

All capital assets are valued at historical cost or estimated historical cost if actual historical cost is not available. Contributed capital assets are valued at their estimated fair market value on the date contributed. It is the policy of the District to capitalize all land, structures and improvements in excess of $5,000 and equipment in excess of $700. The purpose of depreciation is to spread the cost of capital assets equitably among all users over the life of these assets. The amount charged to depreciation expense each year represents that year’s pro-rata share of the cost of capital assets.

Depreciation is provided using the straight line method, which means the cost of the asset is divided by its expected useful life in years and the result is charged to expense each year until the asset is fully depreciated. The District has assigned the useful lives listed below to capital assets: Buildings: 30-50 years / Improvements: 10-20 years /Equipment: 5-40 years /Infrastructure: 10-50 years

NET POSITION

The Statement of Net Position breaks out net position as follows:

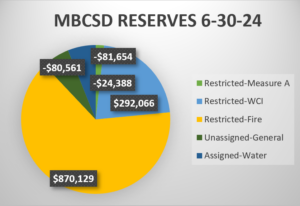

Restricted describes the portion of Net Position that is restricted as to use by the terms and conditions of agreements with outside parties, governmental regulations, laws, or other restrictions that the District cannot unilaterally alter.

Unrestricted describes the portion of Net Position that is not restricted from use.

Audits

NOTE: MBCSD Final Audits are posted when complete and management has approved Draft-Audit reports.

Financial Statements

2022-9 Financial Reports

2022-8 Financial Reports

2022-7 Financial Reports

Budgets

MBCSD Final Budget FY 2024/2025

MBCSD Final Budget FY 2023/2024

MBCSD Final Budget FY 2022/2023

MBCSD Revised Final Budget FY 2021/2022

MBCSD Final Budget FY 2021/2022

MBCSD Revised Final Budget FY 2020/2021

MBCSD Final Budget FY 2020/2021

MBCSD Final Budget FY 2019/2020

MBCSD Final Budget FY 2018/2019

MBCSD Revised Final Budget FY 2017/2018